The small businesses at the heart of our communities are in crisis.

In late 2025, we surveyed 136 independent, brick-and-mortar small businesses across Seattle and surrounding Washington communities. These are neighborhood businesses—cafes, restaurants, shops, salons, studios—that anchor our commercial districts and make our cities walkable, vibrant, and human.

What we heard was sobering. Many small businesses are under more financial stress today than during the height of the COVID-19 pandemic. Foot traffic is down. Costs are rising across every major category. And the emergency-era programs that helped businesses survive have largely ended, even as the need for support remains urgent.

The following is a summary of what small business owners shared, and why it matters.

Who We Heard From

Our survey captured the realities of independent, neighborhood-based small businesses.

- Nearly 70% employ fewer than 10 people, including owners.

- Roughly 80% operate under $1 million in annual revenue, placing most firmly in the micro-business category.

- Respondents include both newer and long-established businesses, underscoring that today’s pressures are not limited to startups or pandemic-era openings.

Businesses span a wide range of industries, including restaurants, cafés, bakeries, retail boutiques, bookstores, bars, health and beauty businesses, and fitness and wellness studios.

A majority identify as women-owned, with significant representation from Asian American, Black, Latino/a/x/e, and LGBTQ-owned businesses—communities that have historically faced greater barriers to capital, stability, and recovery.

Where Businesses Are Located

Respondents operate across Seattle and the broader region, including the Eastside, South King County, and other Washington cities. Within Seattle, businesses span dozens of neighborhoods—from Ballard and Capitol Hill to the Chinatown–International District, Rainier Beach, Greenwood, South Lake Union, and West Seattle.

These are places where small businesses do far more than transact. They contribute to walkability, safety, cultural identity, and a sense of belonging.

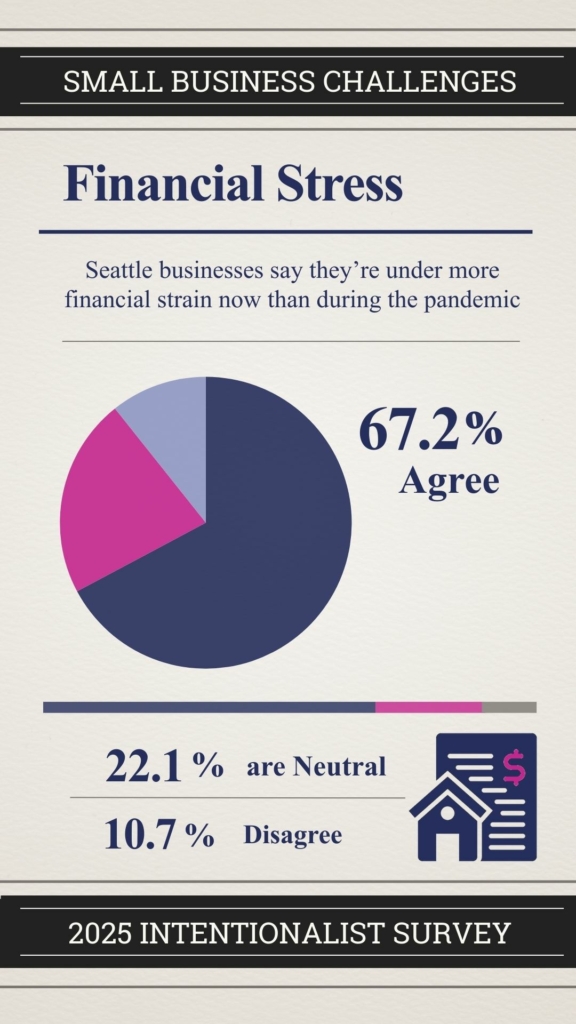

Financial Stress Is Worse Than the Pandemic

One of the clearest findings from the survey:

- 67% of respondents say their business is under more financial stress now than during 2020–2021.

- 73% agree that today’s challenges are less visible than during lockdowns—but just as severe or worse.

The majority of small businesses never recovered from the pandemic. For many, the crisis simply evolved.

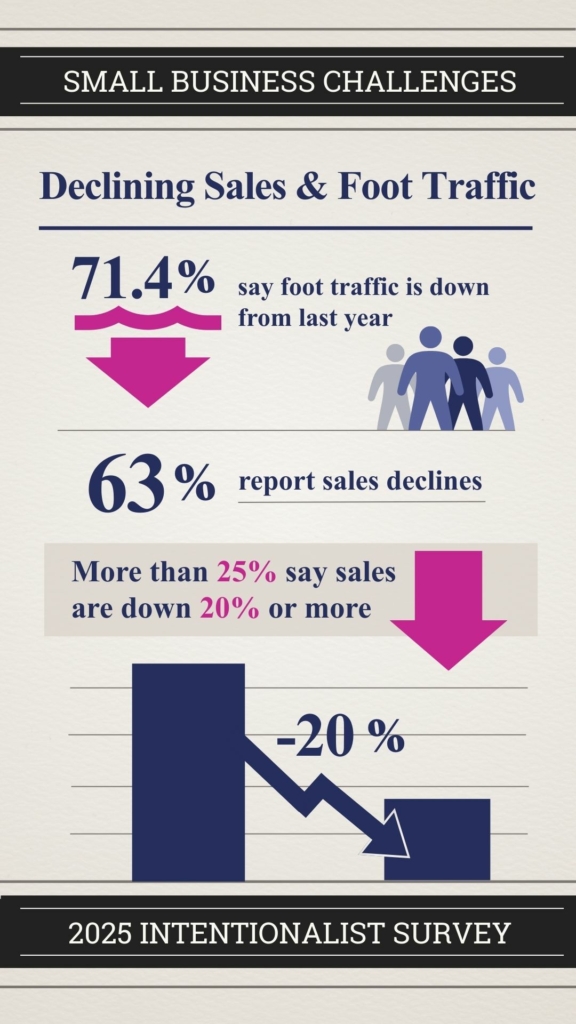

Foot Traffic, Sales, and Demand Are Down

Most respondents report weaker demand than this time last year:

- 71% say foot traffic is lower.

- 63% report declining sales, including more than a quarter experiencing drops of 20% or more.

- Only 12% say customer demand is sufficient to cover today’s cost structures.

When demand softens while fixed costs continue to rise, even well-run businesses face an unsustainable squeeze.

Costs Are Rising Across the Board

Cost pressures are nearly universal. Businesses report increases in:

- Rent and lease costs

- Labor

- Cost of goods and supplies

- Insurance premiums

- Utilities

- Credit and interest costs

Many also note that local policies and fees add meaningful burden at a moment when margins are already thin.

Limited Access to Capital

- 63% of respondents report limited access to working capital or affordable credit.

Many businesses carry higher debt than last year and report limited operating runway if conditions remain unchanged. For micro-businesses in particular, even short-term shocks can threaten long-term viability.

How Business Owners Are Coping

Over the past six months, most respondents report taking multiple survival measures, including:

- Using personal savings or personal credit

- Raising prices

- Reducing staff or operating hours

- Taking on new debt

- Delaying rent, loan, or vendor payments

- Deferring maintenance or safety upgrades

Very few report taking none of these actions. Much of this strain is invisible to customers—but deeply felt by small business owners and their teams.

Safety, Loss, and Insurance Pressures

- 50% of respondents say public safety issues—such as theft, vandalism, or break-ins—are impacting their operations.

Experiences vary by neighborhood, but incidents are common across the dataset. Rising insurance costs, denied claims, and non-renewals further increase financial risk and instability.

The Support Gap

Two findings stand out clearly:

- 80% agree that programs that helped during COVID are no longer available—even though similar support is still urgently needed.

- The types of support businesses say would help most are not what they are currently receiving at scale.

Business owners consistently point to the need for:

- Marketing and events that drive foot traffic

- Corporate and institutional spending with small businesses

- Rent relief or lease stabilization

- Low-interest, patient working capital

- City fee or tax relief

- Insurance premium relief or pooled coverage

What This Data Tells Us

The small businesses we love are struggling to survive. Independent, brick-and-mortar small businesses remain under acute pressure. Sales are down, costs are up, making it becoming increasingly unaffordable to own and operate a small business.

If we care about vibrant neighborhoods, local jobs, and resilient communities, small business stability must be treated as essential infrastructure.

This moment calls for demand-driving strategies, cost stabilization, and intentional institutional spending that reflects the vital role small businesses play in our regional economy.

Methodology & Limitations

- Respondents: 136 independent, brick-and-mortar small businesses

- Field period: November–December 2025

- Geography: Seattle and surrounding Washington communities

- Method: Digital survey using a 5-point Likert scale

Limitations include a self-selected sample, English-only survey, and Seattle overrepresentation. Findings describe direction and magnitude, not causality.

2 responses to “The Small Businesses We Love Are Struggling to Survive”